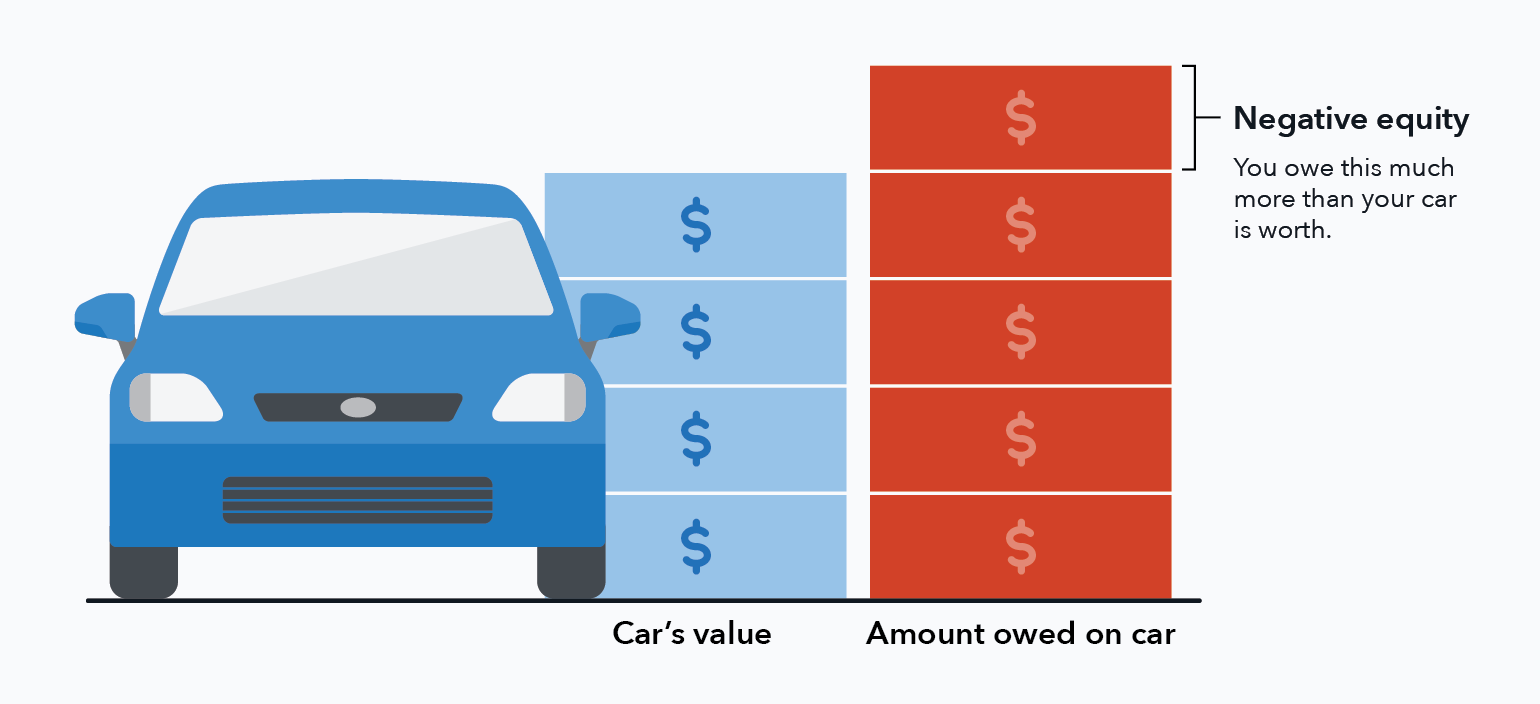

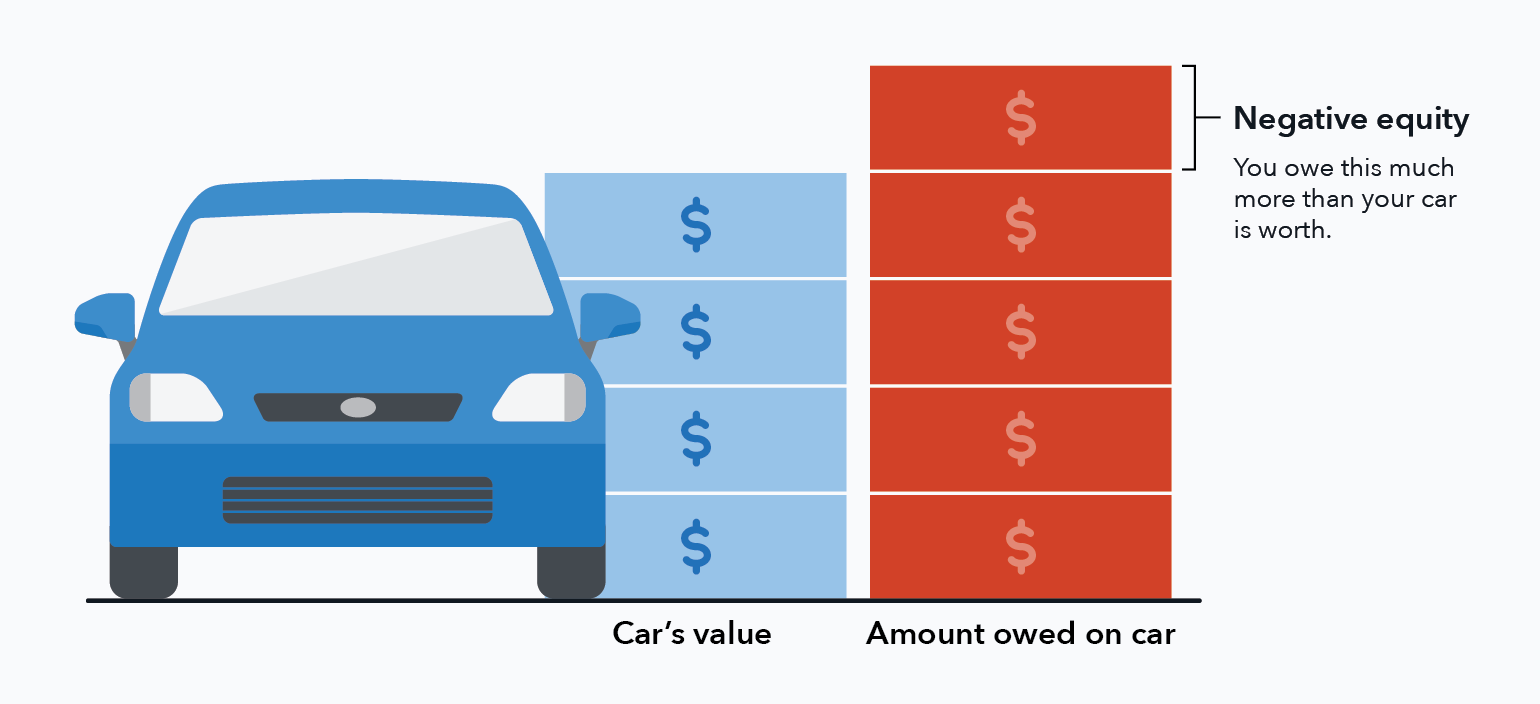

How Can I Get Rid of Negative Equity on My Car? Everything You Need to Know

The average Canadian now carries almost $73,000 in total debt. Non-mortgage debt, which includes credit card use and yes, car loans, account for nearly a

Canadian Auto Brokers » Resources

The average Canadian now carries almost $73,000 in total debt. Non-mortgage debt, which includes credit card use and yes, car loans, account for nearly a

When you need a great deal on your next vehicle or better financing, explore the advantages of working with Canadian Auto Brokers.

Do you have bad credit? Do you know what is considered bad credit in Canada? Do you even know your own score? The average credit score in

With interest rates on the decline these days, why not refinance your auto loan? After all, it’s easier than you may think. With the Federal

Most vehicle owners in Canada don’t realize that their primary insurance will not cover the total value of their vehicle in the event of a

In this time of uncertainty, when our concerns are rapidly expanding in every direction, you shouldn’t have to worry about whether or not you can

There are several ways to purchase a new car. Two of the more common choices are to apply for a bank loan or finance the

Preparation can be the difference between getting a car loan for a great vehicle that fits with your budget, and a financial nightmare that haunts

Applying for car loans is an exciting and stressful balancing act. There’s a lot to consider, from your credit score, to the terms of the

When it comes to applying for a car loan, it’s important to know what kind of loan you should be looking for, and how much

At Canadian Auto Brokers, we take the burden of dealing with banks & dealerships off your back, and help you get the vehicle you want at a payment you’ll love.