Preparation can be the difference between getting a car loan for a great vehicle that fits with your budget, and a financial nightmare that haunts your life and credit score for years to come. Even worse, dealerships and banks are always on the lookout for unsuspecting customers, who haven’t done their research, and are easy to take advantage of. By putting in some time before shopping around for a car loan, you can get a grip of the loan landscape, and find a car loan that works best for you.

In order to get a car loan that best aligns with your needs and desires, you should go in with a full arsenal of knowledge about the loan process and its various aspects. By doing so, you will be in command of the car loan application process, and you won’t get taken advantage of by predatory lenders who don’t have your best interests in mind. Understanding the following factors will ensure that you’re well-equipped and empowered to control the loan application process, and reap the results that come from your preparation.

How Important Is Credit Score?

While credit score is important in a standard loan process, Canadian Auto Brokers works with lenders that see you as a person, and not just a number. Regardless of a low or bad credit score, we won’t stop working on your approval until we get you the best interest rates offered by lenders, which will in turn dictate how much you end up paying for your car loan over its lifetime.

What’s Your Financial Status?

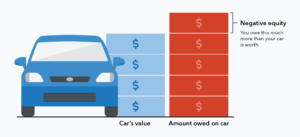

Knowing your financial situation is an important part of correctly navigating the car loan application process. This includes what monthly payments you can afford, how much you can spend over the life of the loan, and how your financial status could change.

Going into the application process with an intimate understanding of where you’re at financially means that you won’t overextend yourself pursuing a car/car loan that you can’t afford, setting you up for long term financial health, rather than more burdensome debt.

Bank or Dealership Financing?

Banks & car dealerships often draw in buyers who haven’t done their research with extremely appealing offers like 0% financing or cash rebates, but these deals aren’t always what they appear to be on the surface. Dealerships either give you the choice of a lower vehicle sale price (cash rebates) OR getting 0%. So you actually don’t save any money. Your “0%” vehicle price is $45,000, vs paying $41,000 for the vehicle if you take 4.9%. These tempting offers are often glossed over in the fine print.

There’s no shame in having low or bad credit, but if you do, steer clear of dealership financing. Always explore all of your options before settling on one, and make sure you know the ins and outs of your financing terms before agreeing to anything.

What is a Pre-Approval?

When shopping for car loans, pre-approval is your ace in the hole. It’s important to understand the power that comes from being pre-approved for a car loan before you begin shopping for your new car. Would you go shopping for a house before knowing how much you’re approved for? Probably not. Pre-approval not only gives you the confidence that you have financial backing while looking at your car options, it also changes your standing in negotiations with lenders.

Having already secured your financing before talking to a dealership means that you have the confidence to negotiate the best deal for yourself. Having pre-approval gives you the status of a cash buyer, which empowers you to get better interest rates while negotiating the terms of your car payments. Always seek pre-approval from trusted companies like Canadian Auto Brokers before you begin shopping for car loans.

Get Your Pre-Approval Online from Canadian Auto Brokers

When Should You Refinance Your Car Loan?

Refinancing a car loan is one of your best tools for getting a good interest rate. After boosting your credit by making a few payments, you can refinance at better rates and lower monthly payments. Canadian Auto Brokers specializes in helping you do just this, so why not apply today!