Most vehicle owners in Canada don’t realize that their primary insurance will not cover the total value of their vehicle in the event of a total loss. This means you could still owe money on a loan or a lease, or not have enough equity left to buy a similar replacement vehicle. You could lose your car and most of the money you invested in it. But is there similar coverage for used vehicles? If you drive a car or truck, you probably need Vehicle Replacement Insurance.

For those of us who purchase or lease a new vehicle, there is an endorsement in an insurance policy called SEF43 that limits the depreciation of the vehicle in the event of a total loss. The coverage is typically 30-36 months from the date of purchase/lease and may vary from insurer to insurer. This is an important coverage to have as newer vehicles typically have higher depreciation rates than used vehicles.

Even though Vehicle Replacement Insurance has been around for years, The reason why most vehicle owners don’t know about this coverage is because most brokers don’t know the coverage exists.

Vehicle Replacement or GAP Insurance can fill the gap in your current coverage by providing comprehensive vehicle replacement protection. Their core coverage will pay the difference between the market value of your vehicle at the time of the loss and your vehicle’s value at policy inception. With optional coverage, you can even escalate your vehicle’s value by 5% per year in the event of a total loss. When vehicles typically depreciate 10-20% per year, there is coverage available that actually appreciates your vehicles coverage by 5% per year. Incredible!!!

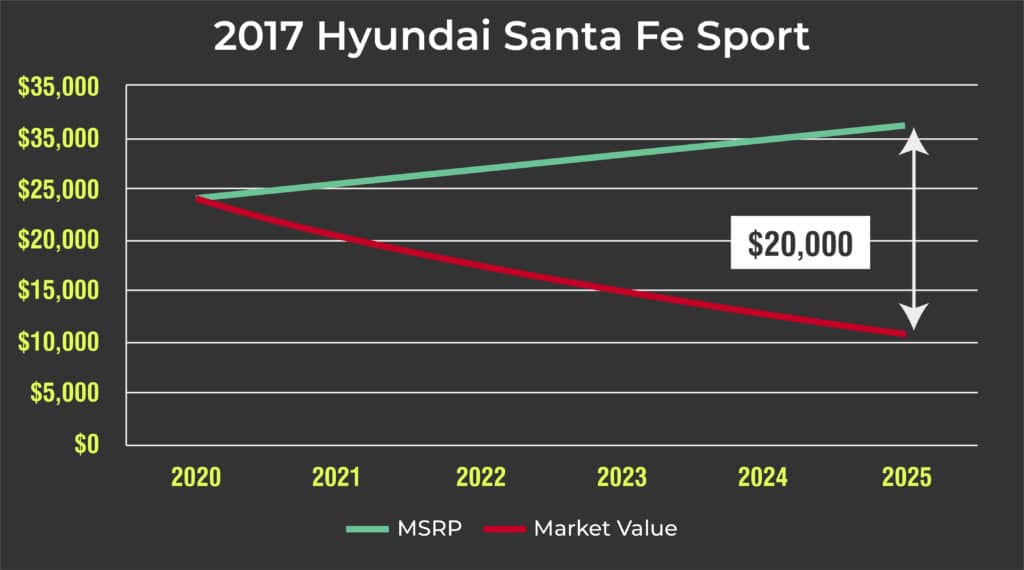

Take a look at the recent client profile below. For the 2017 Hyundai Santa Fe, the black book was calculated to be $24,300, based on odometer reading at time of policy inception. Here we’ve also estimated depreciation at 15%/year while the policy value appreciated 5%/year:

From this chart, if the client was involved in a total loss in the 5th year of coverage, their primary insurer would pay the market value of the vehicle at the time of the loss, estimated to be ~$10,500, while GAP would pay ~$20,000, which is the difference between the black book value at time of policy inception plus 5%/year for the optional coverage minus the market value of the vehicle at time of loss. A ~$32,000 insurance payout would cover any remaining loan and/or a downpayment toward a replacement vehicle.

While their used vehicle program covers up to 5 years of coverage and available to vehicles that are typically less than 10 years old, GAP also offers similar coverage for new vehicle purchases for up to 7 years of coverage. Additional details can be found through your local broker.

Written by:

Brad Stadnyk, CAIB,

DeJong’s Insurance Ltd, Calgary, AB

(403) 869-9090

brad@dejongsinsurance.ca