The average Canadian now carries almost $73,000 in total debt. Non-mortgage debt, which includes credit card use and yes, car loans, account for nearly a third of that, or $23,800.

As you might have guessed, car loans make up the most significant portion of non-housing debt.

What’s more, almost one in three vehicles traded in back in 2018 had negative equity. All these “negative equities” had an average value of -$7,051.

If you’re one of these folks, you’re likely wondering, “How can I get rid of negative equity on my car?” You may be even unsure of what those negative amounts are, and the impact they have on your finances.

Don’t worry, though, as we’re here to clear things up for you. Keep reading so that you can learn all about cars with negative equity and what to do about it!

What Is Negative Equity?

The term “equity” refers to the ownership of assets that have connected “liabilities”. Liabilities are usually in the form of outstanding debts or loans.

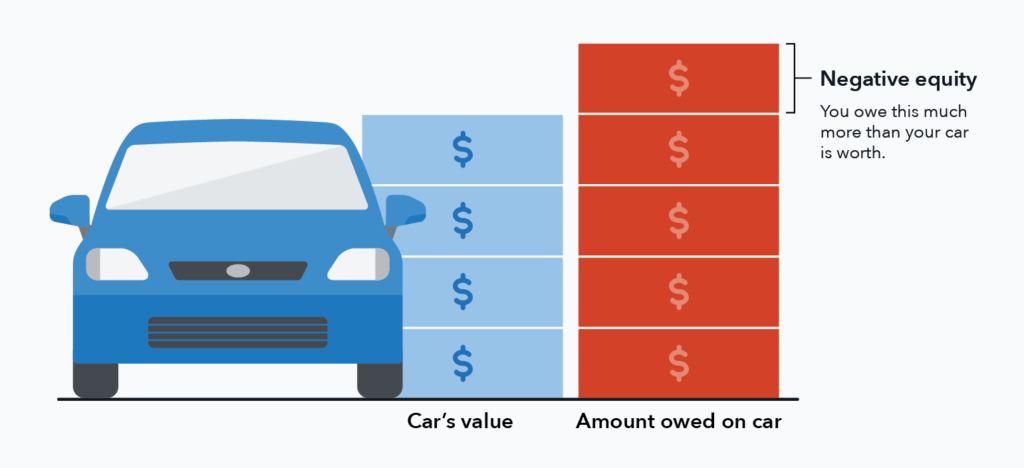

When it comes to liabilities on a car loan, this usually refers to how much you still owe the lender. Negative equity happens when the amount owed is higher than the car’s actual value. Some people also refer to this as “upside-down” or “underwater” car loans.

Either way, this means that you owe more money to your auto loan lender than the car’s financial worth.

It’s quite easy to find out if you have negative equity by knowing these two primary factors. Then, simply subtract your outstanding auto loan balance from your ride’s market value. If it shows up negative, then you have negative equity.

Let’s use the outstanding average car loan debt of $20,000 in Canada as an example. Let’s also say that your vehicle’s actual market value is now only $15,000.

So, $15,000 (your ride’s market value) less/minus $20,000 (your auto loan balance). This means that you have negative equity amounting to $5,000.

How Do You End Up With Negative Equity?

Depreciation, interest rates, credit scores, and down payments all play a role here. The same goes for the loan term you choose, the type of car you drive, and your driving behaviours.

We’ll quickly touch on all the factors below to give you a better grasp of how you can end up with negative equity.

Depreciation

New cars, on average, depreciate at a rate of between 30% and 40% in their first year alone. Most do hold up against depreciation better, but others lose even more. Japanese cars, like Toyota and Honda, are those that seem to retain the most value over time.

You can also end up with negative equity if your car has a quicker depreciation rate. The same is true if you make small payments towards your car loan every month.

Auto Loan Interest Rate

In Canada, auto loan interest rates average between 4.5% and 10%. The lower the interest rate you can secure, the less you’ll owe in total to the lender. This, in turn, reduces your risks of getting “underwater” on your car loan.

Credit Score

Traditional auto loan lenders, like banks, take credit scores into serious consideration. As such, they typically charge higher interest rates to Canadians who have a low or poor score. Most others reject such applicants outright.

With that said, your credit score is one of the most crucial things to know before applying for a car loan. You can get this for free from Canadian Auto Brokers, and it’ll let you know where you financially stand. If it’s too low, don’t run the risk of credit checks from banks that can further lower it.

Down Payment

Making a down payment on a car loan reduces the amount of capital that a lender needs to shell out. As a result, the borrower owes the lending institution less.

This also means that the interest rate applies to a smaller loan amount. As such, you get to enjoy lower interest payments.

Overall, a down payment minimises the gap between the borrowed money and the actual value of the car. By contrast, not making a down payment can also contribute to having negative equity.

Loan Term

If you can afford to pay off your car loan in five years, then you should secure a five-year loan term. That’s because the longer the term is, the more interest it accrues. This, in turn, increases the total amount of what you owe on your car.

Your Car and How You Drive It

The make and model of your ride also influence its price, so the fancier your car is, the pricier it gets. It’s even more expensive to insure luxury vehicles, so that can also add to your auto costs.

As for how you drive it, putting a lot of wear on tear on your ride leads to faster depreciation. A lack of proper maintenance also results in quicker deterioration. All these can then make your car’s value drop lower than similar makes and models.

Why You’d Never Want Negative Equity on Your Car

Negative equity isn’t usually a huge problem if you intend to keep your car for as long as it can serve you. In Canada, this often means driving the same vehicle for an average of 12.88 years. In this case, you may not even know that you’ve had negative equity at some point.

Owing more on your car loan than its actual value becomes an issue if you want to replace it with a new car in just a few years. If it turns out that you have negative equity, then you can no longer use your old car to help pay for the new one. You’d even have to shell out more than what you likely budgeted for the brand-new vehicle.

Things could get worse if you have negative equity and your car gets completely wrecked in a crash. Your auto insurance company will write you a cheque, but it still won’t be enough to pay off your entire car loan debt. You’d have to cover the rest using your own money.

The same goes if you become ill, lose your job, or face a severe life event that renders you unable to pay off the loan. You can’t simply sell off the vehicle since it still has liabilities on it. Even if you find a willing buyer, the money you’ll get from the sale will still be insufficient to pay off your car loan.

How Can I Get Rid of Negative Equity on My Car? The Top Options

Refinancing is one of your best options to get rid of negative equity on your ride. You can even secure a cash-back program or buy a new car and get to eliminate what you still owe on your old car!

Below is a more detailed explanation of all your options to deal with negative equity.

Consider Refinancing

Most Canadians can’t afford not to have a vehicle, considering how 11.4 million of them drive to work. If going car-less isn’t an option for you, then you may want to think about refinancing your current auto loan.

Refinancing gives you the chance to lower the interest rate on your car loan. With a loan refinance, you’ll take out a new loan to replace your old (and most likely high-interest) one. It’s a new contract that allows you to secure not only a reduced interest rate but also better payment terms.

By refinancing your auto loan, you can choose to modify your loan term into a shorter one. This can help you get out of an underwater loan since you’ll pay more towards the loan. Making bigger payments toward your debt then reduces the negative equity on your car.

Being able to lower your interest rate also means you’re making your loan more affordable. The lower the rate, the less of your money goes towards just paying the interest. At the same time, more of your loan repayments covers the actual loan principal.

The smaller your principal loan amount gets, the tinier your negative equity becomes. Also, keep in mind that refinancing won’t involve selling your car to get out of the upside-down loan. As such, you don’t have to worry about not being able to get to work.

Work With an Auto Broker Offering Cash Back Programs

When considering refinancing, be sure to check for extra benefits like cash-backs. You may even qualify for up to $30,000 cash-back when you refinance your existing car! This still depends on the type of vehicle you own, but such programs can help you balance out your equity.

The same cash-back offers typically apply to new car sales too. If you get approved, then you can enjoy a massive cash rebate that can get rid of your negative equity! At the very least, the cash-back you get will eliminate a substantial portion of what you still owe on the old car.

Plus, you get to drive around in a new, potentially-better ride too.

Earn Extra Cash to Make Bigger Loan Payments

Aside from cash-back offers, there are also referral programs offered by auto brokers. You’ll get paid every time a person you refer to the broker contracts with that firm. You can then use the money you earn to make extra payments for your own auto loan.

By paying more towards your car debt, you get to shrink the negative equity too. Every bit of extra payment you make will help you get out of your upside-down loan.

There are plenty of other ways to earn extra income, such as getting side gigs outside of your main job. This, in fact, has become quite the norm in the Great White North, with one in three Canadians having a “side hustle”.

Think About Getting Gap Insurance

As mentioned above, negative equity often becomes a problem when you get involved in a crash. Not only will this leave you without a car if it gets completely wrecked; you’d still need to pay your lender.

The thing is, road collisions are so frequent in Canada that at least 150,000 cases of such events occur every year.

To reduce the risks of having to cover negative equity, consider gap insurance. It’s an optional coverage that shoulders the “gap” between what you owe on your car and its actual cash value (ACV). The ACV is the monetary value of a vehicle at the time of the accident and not its original cost.

So, let’s say that your car’s ACV is $10,000, and you still owe the lender $12,000. The gap here is $2,000, which you’d have to cover using your own money if you end up totalling the vehicle.

If you have gap insurance, however, you won’t have to pay anything else to the lender. Best of all, its cost is only a fraction of comprehensive and collision premiums.

Trade Your Car In

Trading your car in lets you downsize to a less pricey vehicle. Since the “new” vehicle you’ll get will cost less, chances are, you’ll also have less negative equity. This, in turn, makes it easier to pay off, so you can get out of the underwater loan faster.

Do note that you still have to cover the negative equity, though. Nevertheless, if the trade-in makes a vast difference, then it’s worth considering.

Let’s say you still owe your auto loan lender $12,000. Your car’s trade-in value, however, is $10,000. If you push through with the trade-in, then you’ll only owe $2,000, which is easier to pay than the full $12,000.

Say Goodbye to Those Negative Figures Now

There you have it, the ultimate guide that answers your question, “How can I get rid of negative equity on my car?” As you can see, there are several ways to drop these negative figures, with one of the best being a loan refinance. You may even want to buy a new car, so long as it comes with a massive cash rebate.

Want to know more about cash-back programs that can help you deal with negative equity? Then please don’t hesitate to get in touch with us now! We’ll be happy to answer all your questions about these rebates.