With interest rates on the decline these days, why not refinance your auto loan? After all, it’s easier than you may think.

With the Federal Reserve lowering interest rates again, the buzz on Main Street is all about getting a home mortgage refinanced.

That’s a good idea in many cases, but fewer people are talking about another good financial move – refinancing an auto loan.

The case for doing so is solid.

In May of 2019, the average 60-month new auto loan interest rate was around 5.30%. In May of 2020, that average rate has slid down to 4.36% as of May 13, 2020.

That’s almost a full point decline in auto loan rates, representing lower monthly payments on a vehicle loan this year.

“For many Americans, a car is their biggest asset,” said Amy Wang, associate director of Credit Karma Auto. “Refinancing an auto loan is a potential money saving option that many borrowers don’t think of, especially now when rates are so low.”

Wang said that based on her company’s analysis, many U.S. owners who recently refinanced their auto loan have saved an average of nearly $3,000 in total interest over the life of the loan. “That is an average savings of $55 per month,” she said.

Other lending experts echo that sentiment, but note that not every auto lender is eager to reduce a borrower’s monthly payments.

“Our customers saw their monthly car payments decrease by an average of $82 after refinancing, and 32% of customers were able to save over $100 per month,” said Cristy Lynch, senior editor at RateGenius, an online auto refinance loan platform. “Interest rates have fallen since early March as a result of the Federal Reserve rate cuts, so it’s very possible that you can get a lower rate now – even

if your credit hasn’t improved that much.”

But there’s more to consider than just interest rates and credit, Lynch noted.

“Lenders may have other requirements that may make it harder for you to qualify for refinancing,” she said. “This includes minimum loan balances, number of payments made on the current loan, number of remaining payments left, your car’s age and mileage, and the owner having a stable income. That list can go on and on.”

Auto Loan Refinancing Tips

That’s why car owners who want to refinance their interest rates have to take matters into their own hands and be aggressive about finding a good deal. These action steps can help you land a good auto loan refinancing deal:

Rate shop. Auto owners have a 14- to 45-day window to apply for loans without having their credit penalized for multiple hard credit inquiries, so you want to make your inquiries to yield good results.

“Apply for an auto refinance loan with your local credit union or banks or using online loan services where your one application gets you in front of several lenders, thus allowing you to compare interest rates and loan offers handpicked for you,” Lynch said.

Check out refinancing requirements prior to applying. Sometimes a borrower looks great on paper to a lender, but their vehicle doesn’t qualify for refinance.

“For example, some lenders won’t refinance vehicles that are also used for work, so someone driving for Uber (UBER) – Get Report or Lyft (LYFT) – Get Report may not be able to refinance their car loan, even if it’s that’s just their side hustle and not their main source of income,” Lynch noted. “Look at the lending institution’s website for qualification requirements, or give them a call to ask if you can’t find an answer.”

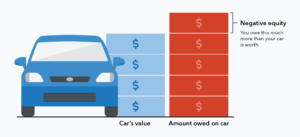

Look at more than just the monthly payment. A lower monthly payment can still mean paying more for your vehicle over time, especially if you extend the loan term too far out, Lynch cautioned.

“That can get you in other financial trouble later on if you’re too far upside down,” she said. “Pay attention to the amount of interest you’ll be paying, as well as when you’ll be finally rid of that car payment. This is particularly important if you’re not planning to keep your vehicle around for a long time. Your goal should be to pay down the loan faster.”

Get your auto data right. It’s “pretty easy” to refinance your auto loan, said Randall Yates, founder and CEO of The Lenders Network. “Just make sure you have all the information about your car and auto loan handy when speaking to a lender.”

Here’s the critical loan information you’ll need, according to Yates:

- Current loan details such as the account number, balance, and interest rate.

- Make, model, year, and VIN number of the vehicle you want to refinance.

- Income documents like current pay stubs and IRS forms.

Check your credit first. Many people who refinance an auto loan do so because they had credit issues. “As a result, they have a high-interest rate on their loan,” Yates said.

That’s why your credit score should be robust, with a FICO (FICO) – Get Report credit score of 700-or-over recommended.

“Before you start applying to refinance your auto refinance loan, I recommend working on improving your credit score first,” Yates said. “This will ensure you’re getting the best rate on a new loan.”

Pros and Cons of Refinancing an Auto Loan

It’s a good idea to take a step back from a new auto loan, and evaluate whether or not refinancing meets your unique financial needs.

“Despite what many banks would have consumers believe, refinancing an auto loan is an incredibly simple process that many people don’t know about,” said Grant Higginson, owner of CanadianAutoBrokers.ca, an auto loan refinancing program that operates across Western Canada. “The only condition that has to be met to refinance is to meet the lending conditions of the new loan.”

That said, borrowers should set their own conditions, too, before signing on the dotted line.

“There are pros and cons involved,” Higginson said. “On the upside, as long as regular payments have been made on the current loan, it’s common that the new loan will have better lending terms. Paying off a an auto loan for at least six months also benefits a consumer’s credit rating. That way, they can receive better rates from prime lenders.”

On the downside, there are plenty of predatory lenders looking to rip off unsuspecting borrowers. “These operators will make it seem like a refinanced loan is ‘too good to be true’ and once they’re signed into a contract a borrower can take a real financial beating,” Higginson said.