Applying for car loans is an exciting and stressful balancing act. There’s a lot to consider, from your credit score, to the terms of the loan, to what car you’re looking to take home. By thinking about this before you begin applying, and avoiding the most common car loan application mistakes, you can ensure that your loan doesn’t become a terrible burden.

Mistake #1: Not Enough Preparation

Solution: If you’re not careful, predatory lenders will take advantage of you. That’s why you need to go into a car loan application prepared. You need to understand where you sit financially. Knowing your budget, long term refinancing options, and the reputation of the lender will protect you throughout this process. Having a solid understanding of all of these factors will give you the best opportunity to lock into an ideal loan for your dream car, and ensure that you don’t get taken advantage of by a dealership that doesn’t have your best interests at heart.

Mistake #2: “Shopping Around” For Loans

Solution: Getting and weighing several financing options might seem like a good idea at first, but seeking financing from multiple dealerships is a mistake that many people make. Each new loan provider will perform a credit check, and even if your credit is good, many checks in a short period will negatively affect your credit score. Your credit information is private, which is why you only want to work with a credible company that has positive online reviews.

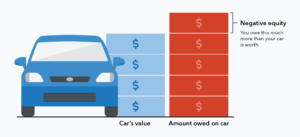

Mistake #3: Focusing On Monthly Payments

Solution: When most people account for their budget, they only take the car loan monthly payments into account. While this is easiest and most logical when making your monthly budget that covers everything in your life, it may not be the best idea when considering your long term financial plan.

Mistake #4: Putting Your Desires Over Your Budget

Solution: Everyone can relate to the feeling of zoning in on something that they know they can’t afford, but breaking this bad financial habit can actually be better for you in the long run. There’s no shame in becoming enamoured with a specific car, but you always need to make sure that you can afford it, before you lock yourself into any deal. Getting pre-approved is a great way to avoid this, because it shows you the kind of range of car you can afford, and goes a long way to prevent opportunistic dealerships from giving you a financing plan that isn’t in your best interests.

Mistake #5: Not Refinancing Regularly

Solution: Once you’ve been approved for a car loan, you need to know what kind of flexibility you have. Making payments will improve your credit score, and you can use this improved score to refinance your car loan at a better rate. Canadian Auto Brokers specialize in refinancing, so why not apply today to get on the path to accessible loans at your lowest rates!